|

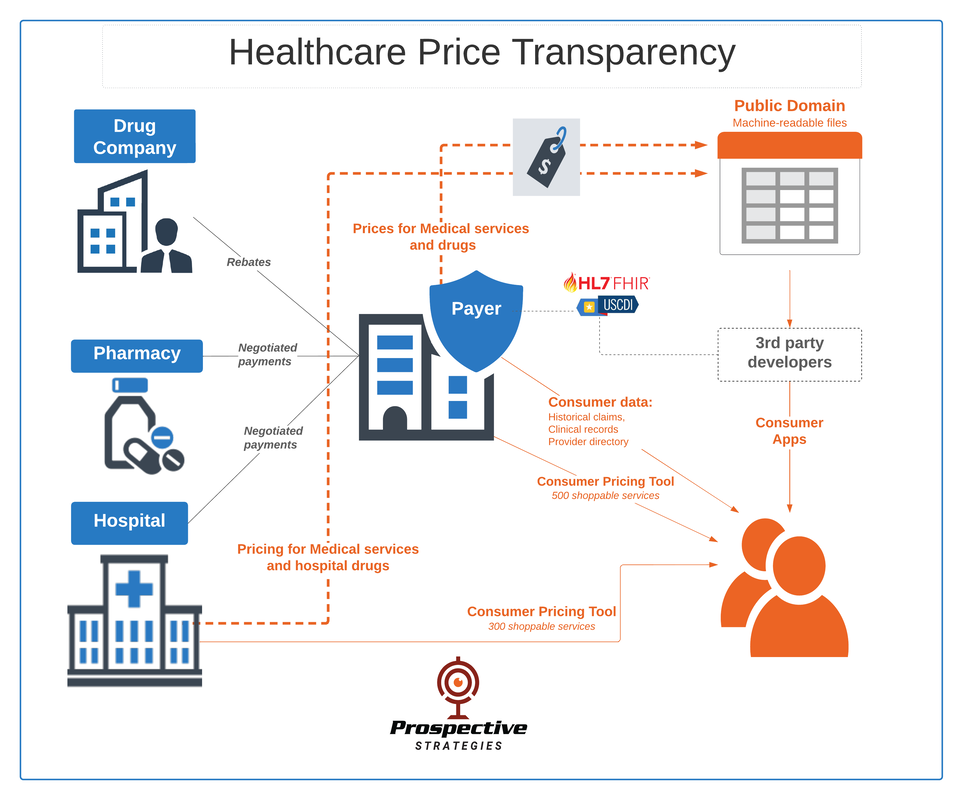

In case you missed it, the shackles are coming off healthcare pricing data. Payers, PBMs and hospitals are releasing massive amounts of previously private pricing data into the public sphere. It looks like a giant data free-for-all... machine-readable files, APIs and consumer tools revealing in great detail:

What pricing data must be disclosed? Hospitals beginning January 1, 2021 For all medical services including hospital-administered drugs, the following will be publicly available on machine-readable files:

Government Program Payers Medicare Advantage, Medicaid/CHIP, QHPs on Federally-facilitated Exchanges beginning January 1, 2021 Interoperability via Application Programming Interfaces (APIs) using standards-based protocols (FHIR HL7) allowing 3rd party developers to create digital apps which enable consumers to access their healthcare data on demand. For all apps developed using these APIs, usage will be consumer-directed with secure delegated access (OAuth) regardless of carrier.

Insurers and Group Health Plans Individual market and non-grandfathered group plans beginning January 1, 2022 (enforcement 7/1/2022) For all medical services and drugs, make publicly available machine-readable files for the following:

New opportunities, new threats Beyond the immediate compliance and operational challenges, industry stakeholders should take advantage of new opportunities while mitigating risks arising from these new data sources:

Prospective Strategies empowers healthcare business transformation. With the right strategy, you can unlock your product potential and maximize market opportunity.

0 Comments

Leave a Reply. |

Archives |

|

612.552.2228

info@prospectivestrategies.com New Product / Services Launch Benefit Design / Market Research Portfolio Risk Management Expertise: Medicare/Medicaid, Pharmacy Benefits Management, Self-insured Employers |